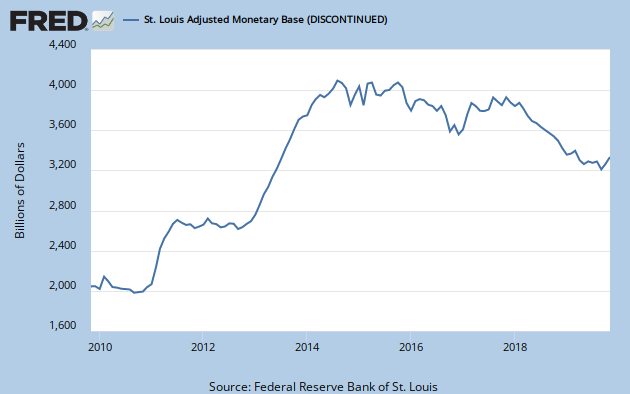

Monetarist's would rely on inflation to be too many dollars chasing too few goods and services. The Monetarist's see a chart showing the base money supply with a trend line as in the one below, and they have no bigger fear than the imminent arrival of inflation.

(click on the image for a larger view)

This is strong evidence enabling their call, warning of inflation as the next economic condition. As you see, they had a very compelling argument for inflation getting underway, starting in the center of the gray bar defining the period of this recession. Yet it has not become a factor worthy of recognition. Next, take a look at the credit outstanding chart that Austrian's want to see.

(click on the image for a larger view)

(click on the image for a larger view)Credit has been in decline until the past several weeks. The increase might be attributed to mortgage lending spiking ahead of the expected November 31 end of the First Time Home Buyers tax credit, which has recently been extended. Time will tell if the upturn grows or not. This could be a foretelling of inflation coming sooner than many Austrian's have predicted. Now let's briefly consider this question from the Keynesian perspective.

There is a very different and complex definition of inflation coming from the Keynes theory on economics. Here the focus is on prices. This theory, and the concept of inflation is price-related rather than money-related. Today, it is a source of contention. The issue concerns the appropriateness of a price-based definition of inflation in the first place. A rise in prices is an outcome that can be activated by three factors: too few goods and services on the market, a society moving towards less saving and more spending, or an increase in the supply of money and credit. So the Keynesian price focus of inflation is very subjective, and difficult to measure. There may be a better description of inflation from Keynesian's and I would like to know it. I am presenting the best I have seen. If you feel like you are experiencing inflation and can point price increases then the Keynsian model will support your contention.

Alright then, where does this get us today? The question is are we experiencing inflation or deflation? Are we there now or is it lurking around a corner? Obviously what school of thought you like matters as well as your observations of the economic condition. For me the answer is that we are currently experiencing deflation. When asset values stabilize to their market levels, the federal stimulus will have to have ended first, then I expect we'll be left with elements of both deflation and inflation for some period of time. This condition is stagflation. I suspect we'll get to know more about stagflation than we want to as time rolls on. We'll get through it OK, but our standard of living will change to smaller than we have enjoyed over the past many years. 'Living life large' is going to be a memory for many of us. Change is good...just not easy.