| Market Index/Data | 12/30/2022 | 9/29/2023 | Change | Simple YTD |

| Dow Industrials Avg | 33,147.25 | 33,505.50 | -458.34 | 1.08% |

| S&P 500 Index | 3,839.50 | 4,288.05 | -32.01 | 11.68% |

| Fed Funds Rate | 4.33% | 5.33% | 0.00% | 23.09% |

| 10 yr T-note Yld | 3.88% | 4.59% | 0.15% | 18.30% |

| 5 yr T-note Yld | 3.99% | 4.60% | 0.03% | 15.29% |

| 5 yr TIPS - 'Real' Yld | 1.66% | 2.54% | 0.26% | 53.01% |

| Implied 5 yr Inflation % | 2.33% | 2.06% | -0.23% | -11.59% |

| 2 yr T-note Yld | 4.41% | 5.03% | -0.07% | 14.06% |

| 2-10 Yr Slope | -0.53% | -0.44% | 0.22% | -16.98% |

| 90 day T-bill Yld | 4.42% | 5.55% | -0.01% | 25.57% |

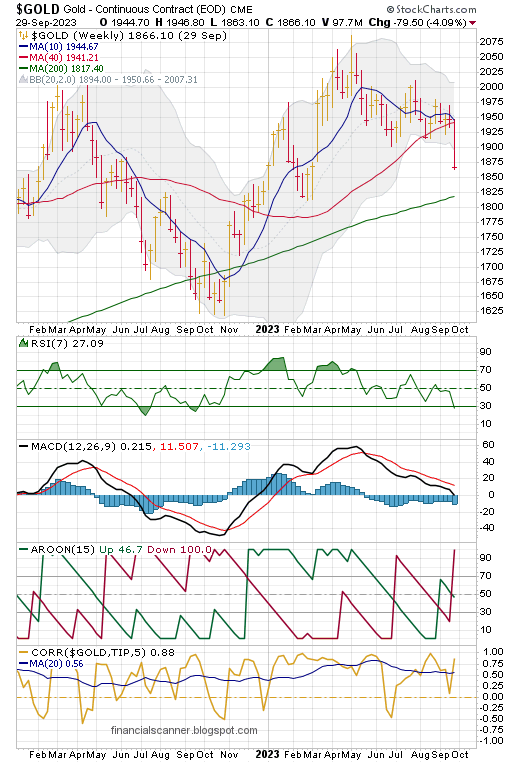

| Gold ($/oz) | $1,826.20 | $1,866.10 | -$79.50 | 2.18% |

| WTI Oil ($/brl) | $80.26 | $90.79 | $0.76 | 13.12% |

| VIX "Worry Index" | 21.67 | 17.52 | 0.32 | -19.15% |

| NYSE Bullish % Index | 40.87% | 40.43% | -3.58% | -1.08% |

|

|

|

|

|

| Credit Data | 12/30/2022 | 9/29/2023 | Change | Simple YTD |

| iShares Agg. Bond ETF Yield (AGG) | 2.51% | 3.11% | 0.06% | 23.90% |

| SPDR High Yld Credit ETF Yield (JNK) | 6.49% | 6.79% | 0.15% | 4.62% |

| Invest. Gr. to 10 yr T-Note Spread (x 10) | -1370 | -1480 | -90 | -110 |

US Treasury Yields, 90 day, 2, 5, 10 & 30 Yr, Weekly

Investment Grade Credit & Junk Grade Credit, Weekly Price

Inflation Expectations, Weekly

NYSE Internal Sentiment, Weekly

Weekly Worry Indexes

US Dollar Index, Weekly

Gold Spot Price, Weekly (not bullion or coins)