| Market Index/Data | 12/30/2022 | 12/29/2023 | Change | Simple YTD |

| Dow Industrials Avg | 33,147.25 | 37,689.54 | 303.57 | 13.70% |

| S&P 500 Index | 3,839.50 | 4,769.83 | 15.20 | 24.23% |

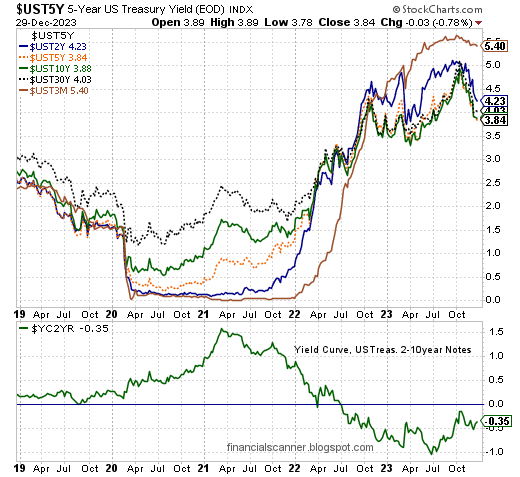

| Fed Funds Rate | 4.33% | 5.33% | 0.00% | 23.09% |

| 10 yr T-note Yld | 3.88% | 3.88% | -0.02% | 0.00% |

| 5 yr T-note Yld | 3.99% | 3.84% | -0.03% | -3.76% |

| 5 yr TIPS - 'Real' Yld | 1.66% | 1.72% | 0.01% | 3.61% |

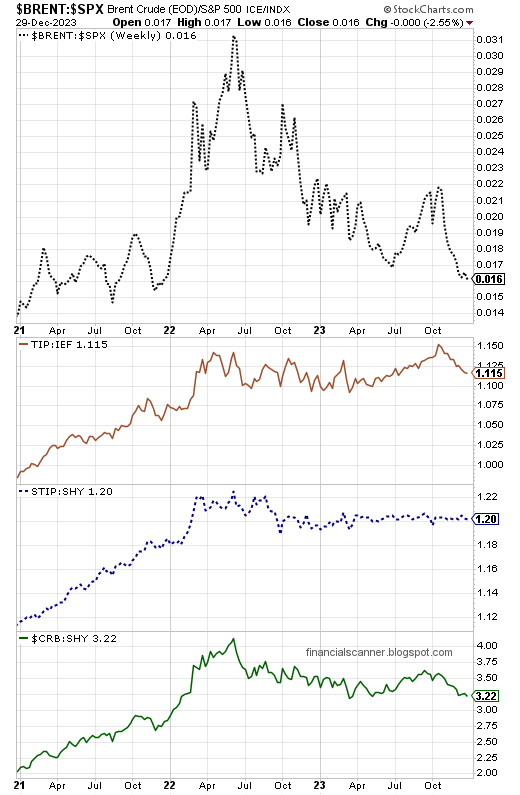

| Implied 5 yr Inflation % | 2.33% | 2.12% | -0.04% | -9.01% |

| 2 yr T-note Yld | 4.41% | 4.23% | -0.08% | -4.08% |

| 2-10 Yr Slope | -0.53% | -0.35% | 0.06% | -33.96% |

| 90 day T-bill Yld | 4.42% | 5.40% | -0.04% | 22.17% |

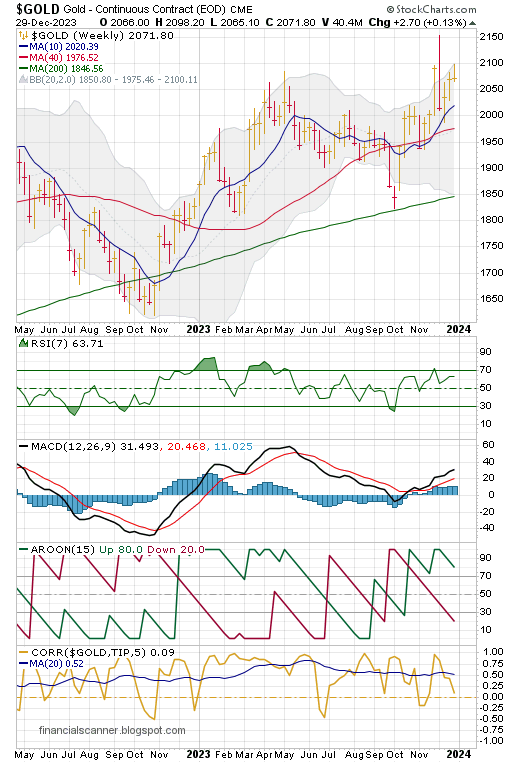

| Gold ($/oz) | $1,826.20 | $2,071.80 | $2.70 | 13.45% |

| WTI Oil ($/brl) | $80.26 | $71.65 | -$2.24 | -10.73% |

| VIX "Worry Index" | 21.67 | 12.45 | -0.58 | -42.55% |

| NYSE Bullish % Index | 40.87% | 66.83% | 1.26% | 63.52% |

|

|

|

|

|

| Credit Data | 12/30/2022 | 12/29/2023 | Change | Simple YTD |

| iShares Agg. Bond ETF Yield (AGG) | 2.51% | 3.36% | -0.01% | 33.86% |

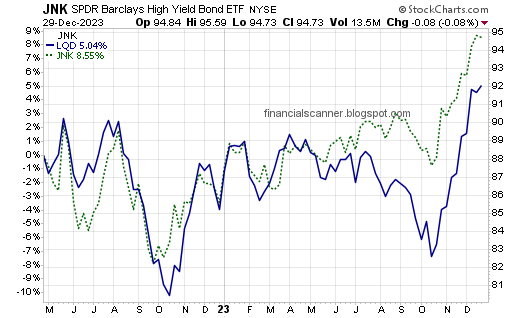

| SPDR High Yld Credit ETF Yield (JNK) | 6.49% | 6.99% | 0.01% | 7.70% |

| Invest. Gr. to 10 yr T-Note Spread (x 10) | -1370 | -520 | 10 | 850 |

US Treasury Yields, 90 day, 2, 5, 10 & 30 Yr, Weekly

Investment Grade Credit & Junk Grade Credit, Weekly Price

Inflation Expectations, Weekly

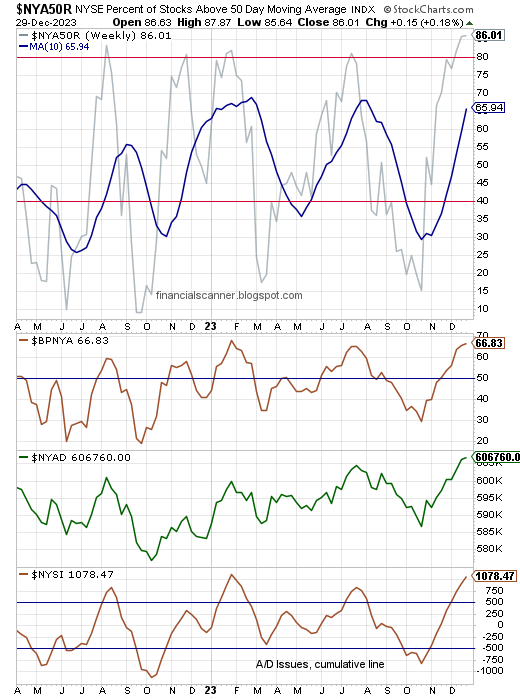

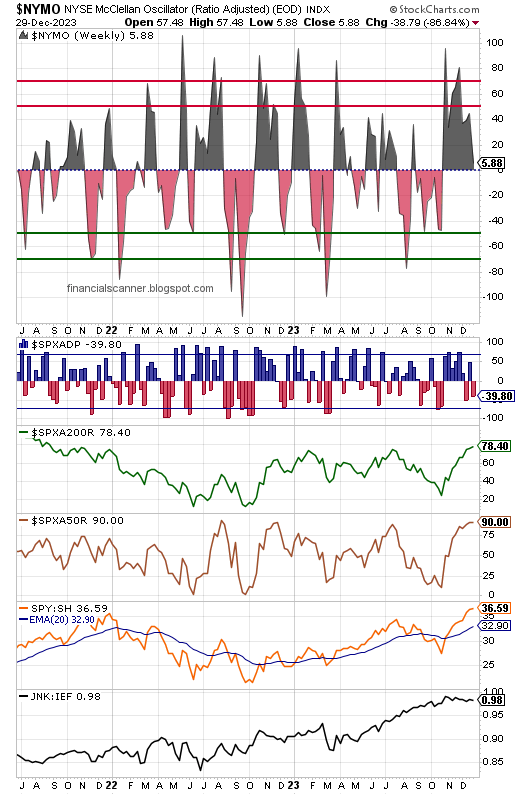

NYSE Internal Sentiment, Weekly

Weekly Worry Indexes

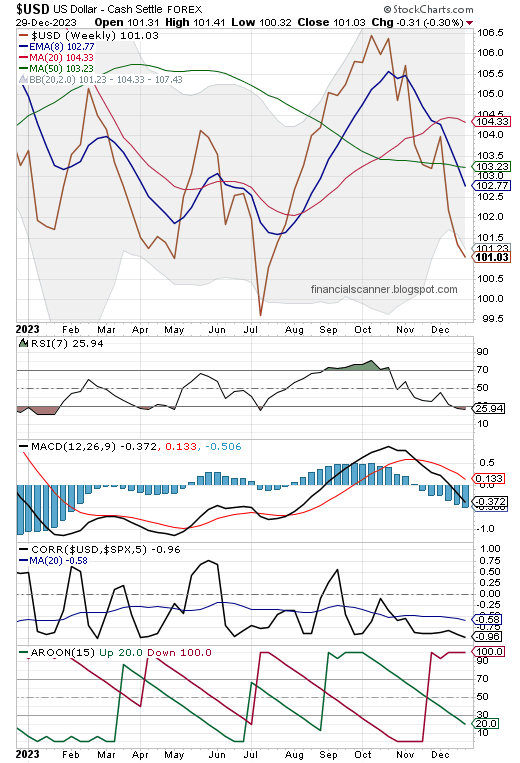

US Dollar Index, Weekly

Gold Spot Price, Weekly (not bullion or coins)