| Market Index/Data | 12/29/2023 | 3/1/2024 | Change | Simple YTD |

| Dow Industrials Avg | 37,689.54 | 39,087.38 | -44.15 | 3.71% |

| S&P 500 Index | 4,769.83 | 5,137.08 | 48.28 | 7.70% |

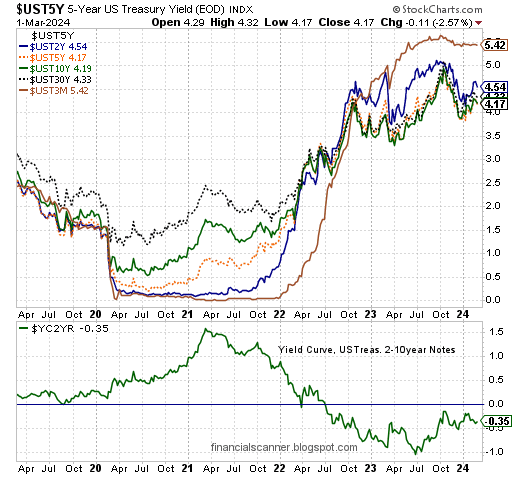

| Fed Funds Rate | 5.33% | 5.33% | 0.00% | 0.00% |

| 10 yr T-note Yld | 3.88% | 4.19% | -0.07% | 7.99% |

| 5 yr T-note Yld | 3.84% | 4.17% | -0.11% | 8.59% |

| 5 yr TIPS - 'Real' Yld | 1.72% | 1.77% | -0.17% | 2.91% |

| Implied 5 yr Inflation % | 2.12% | 2.40% | 0.06% | 13.21% |

| 2 yr T-note Yld | 4.23% | 4.54% | -0.13% | 7.33% |

| 2-10 Yr Slope | -0.35% | -0.35% | 0.06% | 0.00% |

| 90 day T-bill Yld | 5.40% | 5.42% | -0.04% | 0.37% |

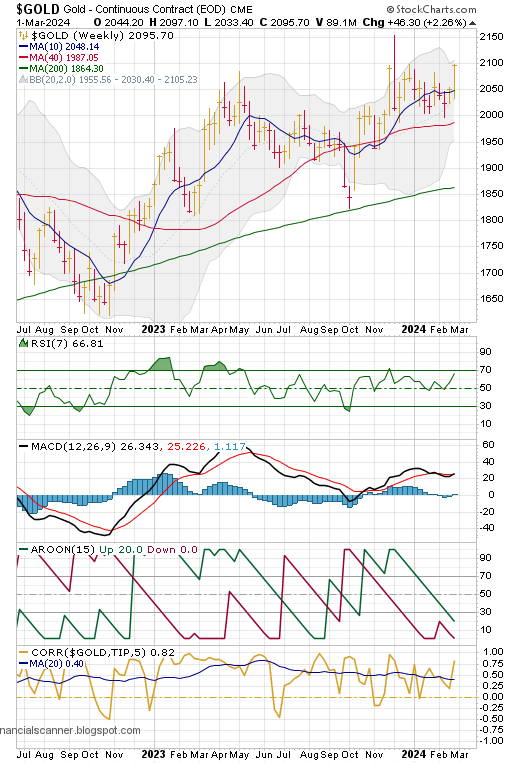

| Gold ($/oz) | $2,071.80 | $2,095.70 | $46.30 | 1.15% |

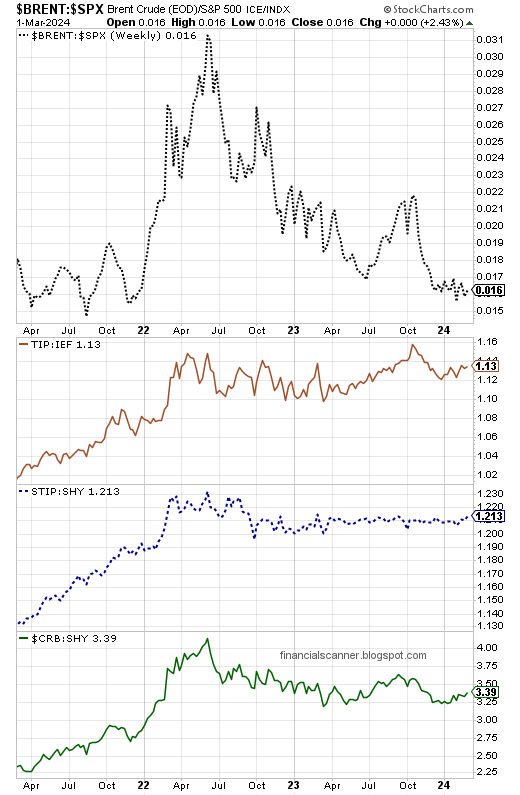

| WTI Oil ($/brl) | $71.65 | $79.97 | $3.48 | 11.61% |

| VIX "Worry Index" | 12.45 | 13.11 | -0.64 | 5.30% |

| NYSE Bullish % Index | 66.83% | 60.99% | 2.09% | -8.74% |

|

|

|

|

|

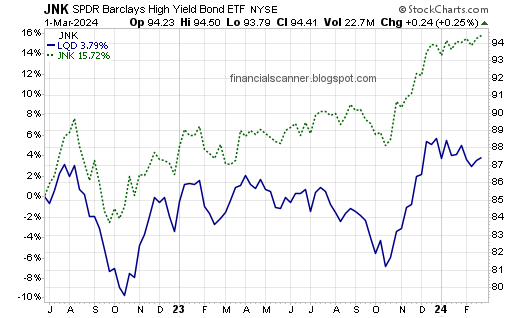

| Credit Data | 12/29/2023 | 3/1/2024 | Change | Simple YTD |

| iShares Agg. Bond ETF Yield (AGG) | 3.36% | 3.24% | 0.00% | -3.57% |

| SPDR High Yld Credit ETF Yield (JNK) | 6.99% | 6.46% | 0.02% | -7.58% |

| Invest. Gr. to 10 yr T-Note Spread (x 10) | -520 | -950 | 70 | -430 |

US Treasury Yields, 90 day, 2, 5, 10 & 30 Yr, Weekly

Investment Grade Credit & Junk Grade Credit, Weekly Price

Inflation Expectations, Weekly

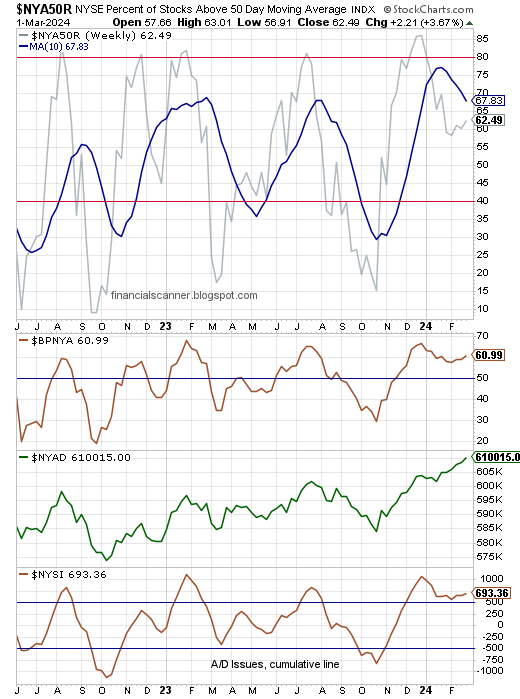

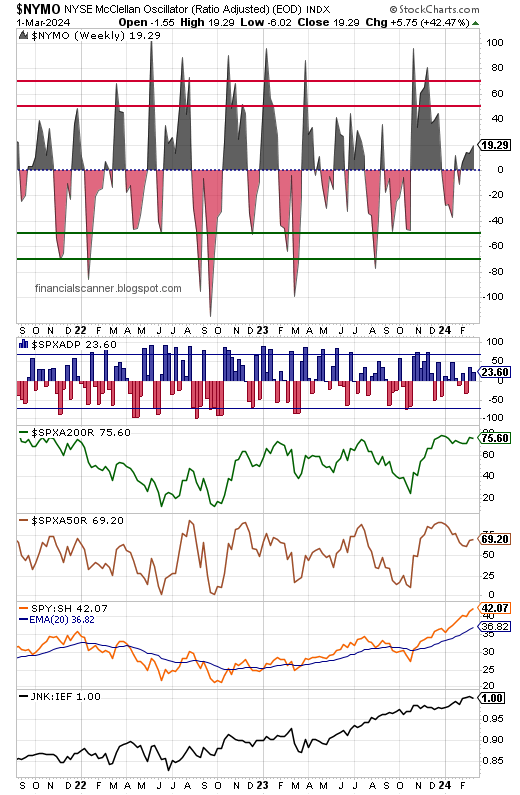

NYSE Internal Sentiment, Weekly

Weekly Worry Indexes

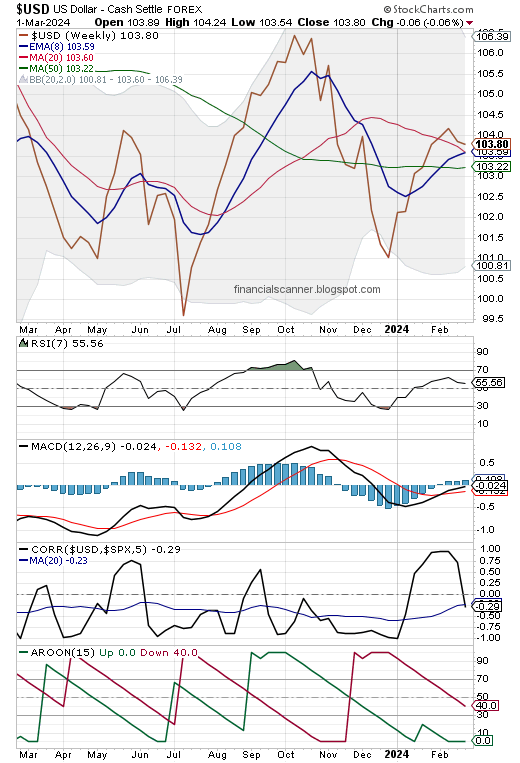

US Dollar Index, Weekly

Gold Spot Price, Weekly (not bullion or coins)